Lloyds Share Price Forecast

Strong Capital Position: The bank passed the 2025 Bank of England stress test comfortably, demonstrating resilience.

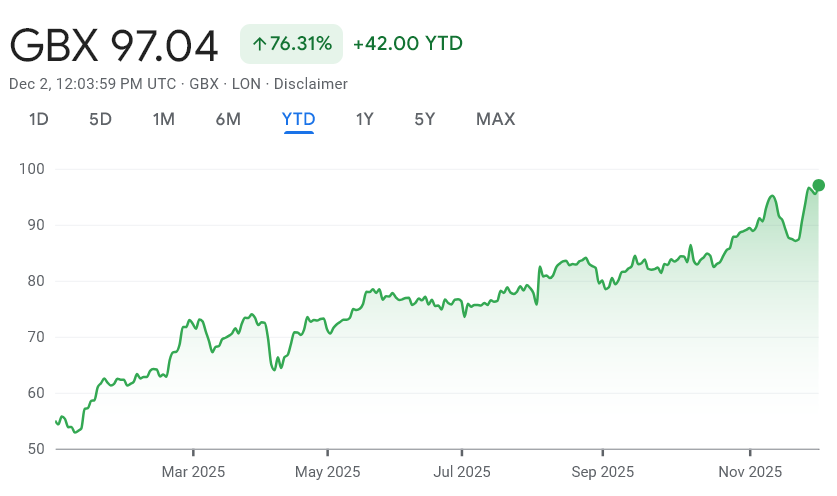

Proximity to £1: The share price has recently been very close to the 100p mark (e.g., reaching over 96p in late November 2025). Many analysts and investors view breaking the £1 barrier as likely or “inevitable,” though the timing is uncertain.

Analyst Targets: While short-term analyst consensus targets have been near or slightly below 100p (e.g., a median target of 99.50p in one recent analysis), some analysts have higher targets, such as 110p or 115p within the next year, indicating a belief in significant future growth.

Drivers for Growth: Recent growth has been fueled by factors including:

High Interest Rates: Lloyds benefits from higher interest rates, which boost net interest margins (NIMs)—the difference between what a bank earns from lending and pays out on deposits.

Legal Clarity: Resolution or clarity regarding the motor finance mis-selling scandal has reduced uncertainty.

Why Reaching £1 is Important

While £1 is a psychological milestone rather than a fundamental valuation marker, hitting this price is important for several reasons:

- Investor Confidence: It would be a significant psychological victory for shareholders, marking a return to levels not seen since 2008 and confirming the strong recovery narrative.

- Market Perception: Crossing the £1 threshold would help shed the long-standing “penny share” perception, potentially attracting a broader range of institutional investors who may have internal rules against investing in sub-£1 stocks.

- Valuation: Although the price itself doesn’t change the company’s value, it often reflects a belief that the bank is no longer significantly undervalued, as some analysts currently estimate it to be.

Link to the UK’s Economic Health

A rising Lloyds share price is often seen as a barometer for the UK economy, but it does not unilaterally mean the UK’s economy is getting better.

- Positive Signal (Retail Banking): Lloyds is primarily a domestic UK bank, deriving almost all its profits from UK customers (mortgages, loans, and current accounts). A higher share price reflects a positive outlook for its core business, which is highly sensitive to UK economic conditions like stable employment, rising house prices, and consumer spending.

- Contradictory Driver (Interest Rates): The recent boost to Lloyds’ profitability has largely come from high interest rates. While high rates can benefit banks, they often indicate an effort by the Bank of England to control inflation, which can slow the broader economy (e.g., through higher mortgage costs for consumers).

- Conclusion: The share price rise suggests that the UK’s financial services sector is performing well and that the market has a positive view of Lloyds’ ability to profit from the current economic landscape (especially higher interest rates), rather than being a conclusive indicator of widespread economic improvement.

Lloyds’ Influence on the UK Market and Business

As the UK’s largest retail bank, Lloyds Banking Group exerts significant influence on the UK market and business environment:

- Lending and Credit: Lloyds is a major provider of mortgages, personal loans, and credit cards. Its policies on lending—availability, rates, and criteria—directly impact households, consumer spending, and the UK housing market.

- Business Support: Its Commercial Banking division is crucial for supporting businesses of all sizes, especially Small and Medium-sized Enterprises (SMEs). The bank has committed large amounts of new finance (e.g., over £35 billion in one recent year) to UK businesses, which directly supports jobs, capital investment, and economic growth across various sectors.

- Market Confidence: Due to its size and domestic focus, its performance and financial stability—reinforced by passing stress tests—are important for maintaining confidence in the entire UK financial system and the broader FTSE 100 index.