The financial services industry, long known for its traditional structures, is experiencing a refreshing shift. Women are making their presence felt at all levels, from financial advisors and portfolio managers to executives and board members.

At the forefront of this progress are women like Bazal Morani, the CEO of Empire Central Financial. She is an inspiration to a new generation entering the field. Through her dedication and expertise, Morani exemplifies the positive impact women are making on the financial landscape, paving the way for a more inclusive and successful future for the industry. We, at EliteX, are honored to introduce Bazal Morani as one of the most Impactful Women in Finance in 2024.

Bazal Morani empowers women entrepreneurs to achieve both business and personal financial success. Under her strong leadership, Empire Central Financial takes a holistic approach to financial planning by deep diving into the intricate details of a client’s business and personal life. The company determines the underlying needs and addresses them head-on without bias or judgment.

“We not only provide the products and services needed to protect and grow finances but also educate the clients on the values and benefits of each product and service and compare to others to demonstrate the value and growth.”

This cover story delves into the evolving landscape of women in finance, exploring their contributions, and the exciting opportunities that lie ahead.

The Evolution of an Entrepreneur

Bazal Morani’s journey in the financial services industry began in a unique way. As an early childhood educator, she also assisted her father’s CPA firm, handling business operations and development, and filling service gaps like life insurance and notary work. During industry meetings or club gatherings, Morani often found herself as one of, if not the only, woman in the room.

“This made me notice that women just weren’t being well represented in the financial industry and needed someone more aligned with the needs of women to represent and serve them,” Morani observes.

Driven by this observation, she decided to bridge the gap. When her father needed her full-time support, she pursued an MBA in business finance, aiming to become an expert her clients could trust. This wasn’t just about selling policies; it was about understanding their needs and offering informed guidance. To further solidify her expertise, she embarked on CFP training, making her position as a well-rounded professional in the financial services industry.

Morani says, “I wanted to become someone that can represent minorities and advocate for them in the best way possible by helping them protect and grow their financial assets and build their empire.”

Learning from Mentors

Morani’s path in finance was shaped by a strong network of influential figures. Her mother instilled in her the values of strength, authenticity, and unwavering commitment to helping others. This resonates deeply with Morani’s approach to success, which transcends financial gain.

Her father, meanwhile, became her window into the world of finance, guiding her through its complexities and equipping her with the knowledge and tools needed to thrive. Witnessing his dedication to making a positive impact further fueled her desire to do the same.

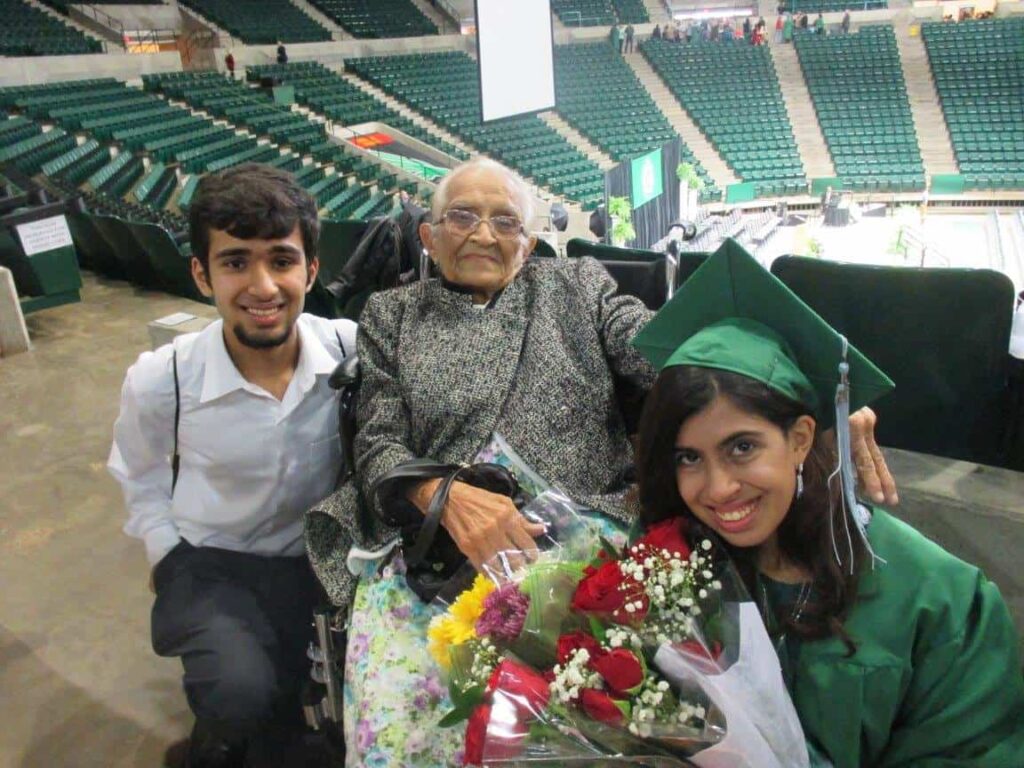

Beyond her parents, Morani’s grandparents also played a role. While primarily through stories, their influence was significant. Her paternal grandmother, a former teacher, nurtured Bazal’s love for education, shaping her approach to enriching the knowledge of those around her. Similarly, her maternal grandparents, pioneers in advocating for the underprivileged, inspired Morani to focus her career on serving underserved communities within the financial sector.

The Essential Skills for Success

“The priority should always be the needs of the clients and what they need to protect and grow their finances rather than what makes you more money as a financial planner.”

Morani attributes her success to a deep understanding of her clients’ needs, risk tolerance, and commitment to ethical practices. She prioritizes transparency, ensuring clients are fully informed about the products and services they choose. Her dedication to continuous learning keeps her at the forefront of industry developments, allowing her to empower clients to make informed decisions and guide them on their financial journey.

To maintain her industry expertise, Morani actively participates in advanced training programs and stays updated through industry organizations and publications. This continuous learning ensures she remains equipped to provide her clients with the most relevant and effective financial guidance. Along with this, it also helps her to foster trust and build long-term client relationships.

Morani’s Approach

The daily demands of running a business, especially in financial advising, require making numerous quick decisions while navigating complex client challenges. Morani, however, approaches this with clarity: her client’s interests always come first.

This principle, deeply rooted in her professional and personal training, guides every decision she makes. By prioritizing her clients’ well-being, she minimizes both client and firm risk, highlighting the critical role of strong ethical principles in sound financial decision-making.

Morani’s commitment to decision-making extends beyond client interactions. Recognizing the importance of a healthy work-life balance for overall well-being and success, she maintains a well-defined schedule that allows her to dedicate time and energy to both professional pursuits and personal fulfillment.

She adds, “I enjoy kickboxing as my personal calming hobby along with playing with my dog Prince. It allows me to release tensions through the exercise while getting the well-needed joy and happiness through Prince. I think everyone should find something that allows them to express themselves.”

Navigating uncertainty with care

Morani recently encountered a family facing a challenging situation. Two key members were battling personal health issues, while also worrying about their financial future due to the lack of essential documents like a Will, Medical Power of Attorney, and Living Will. Recognizing their distress, Morani provided them with a cost-effective and efficient service to secure these attorney-drafted documents.

Through a dedicated and compassionate approach, Morani meticulously guided them through the options and execution process. This proactive planning ensured clarity and control over their financial matters, alleviating their anxieties and bringing a sense of relief. As always, Morani ensured they felt empowered and understood throughout the process, reflecting her commitment to client comfort and well-being, even in difficult circumstances.

Gender Dynamics in Finance

In 1970, the start of the evolution for women in finance began when the Equal Credit Opportunity Act was passed. However, women still aren’t taken as seriously when it comes to the financial industry which is surprising since women are increasingly taking over family finances and are expected to take over more financial decisions in the coming years.

Morani would like to see women become more confident in their financial literacy and decision-making and take charge of their financial empire to help further educate and empower future generations at an early age to make sound financial decisions.

Women’s Leadership in Fintech

According to Morani, there are two challenges when it comes to the role of women in the fields of fintech and digital finance. The level of representation of women in the finance industry and the level of representation of women in the technology industry.

They are both still not at the level it seems to be from the outside. The question remains, would the representation challenge be bigger if they both come together?

Morani says, “I have a feeling that fintech and digital finance will open up many new opportunities for women in the profession. I think it will be a challenging new arena and interesting and we women like to take on challenging opportunities so, you may see some real growth in women’s representation in these industries.”

Protecting Your Revenue Streams

The biggest challenges that come to a family are when there are health issues. Morani advises us on the following Income Protection Strategies

- Health Insurance: Ensure adequate health coverage to address unforeseen medical situations.

- Disability Income Insurance (DI): Don’t overlook this affordable insurance. It replaces your regular income if you become disabled, preventing financial hardship.

- Business Expense Insurance (BE): For business owners, combine DI with BE. This protects your business’s income if you become disabled, preventing closure.

- Life Insurance: Provides financial security for your family in the event of your untimely death. It can also be used to create a secure retirement income, offering an alternative to potentially unreliable social security.

Bearing in mind that everyone’s financial needs and plans will be different based on personal circumstances and goals, it is always advised to speak to a financial planner and have personal action plans created to get the best approach going forward.

Morani’s Guidance for Young Women in Finance

“Continually grow your knowledge base and aspire to learn more and become an expert in your field. Be confident in sharing your knowledge and networking with others within the industry even if you start as the only woman or person of color in the room, you will become the inspiration for others to join within your community.

Don’t be afraid to show your face and knowledge and get your name out there. But most importantly be true to who you are and those who connect with you and your message will find you.”