As we evolve in a tech-driven world, the tech industry is growing, hitting investment records and attracting investors.

The current pandemic imposed, almost obligatory, health protocols and precautionary measures to curve out its effects. In this effort, social distancing guidelines and work-from-home setups were implemented. As COVID-19 caused physical separation, technology kept us digitally connected. Due to current circumstances, our relationship with technology has strengthened. Employees working remotely sought upgrades on their laptops, computers, and mobile devices. Improvements on internet connectivity and home wifi system have increased. New software applications have been introduced to provide modern solutions to traditional activities by providing customers access to online shopping, mobile food delivery, online logistics, virtual health check-ups, and alternative virtual learning platforms. With such demand for technology, can we now infer that we are at the right time, with the right reasons, to invest in technology?

Technology Industry

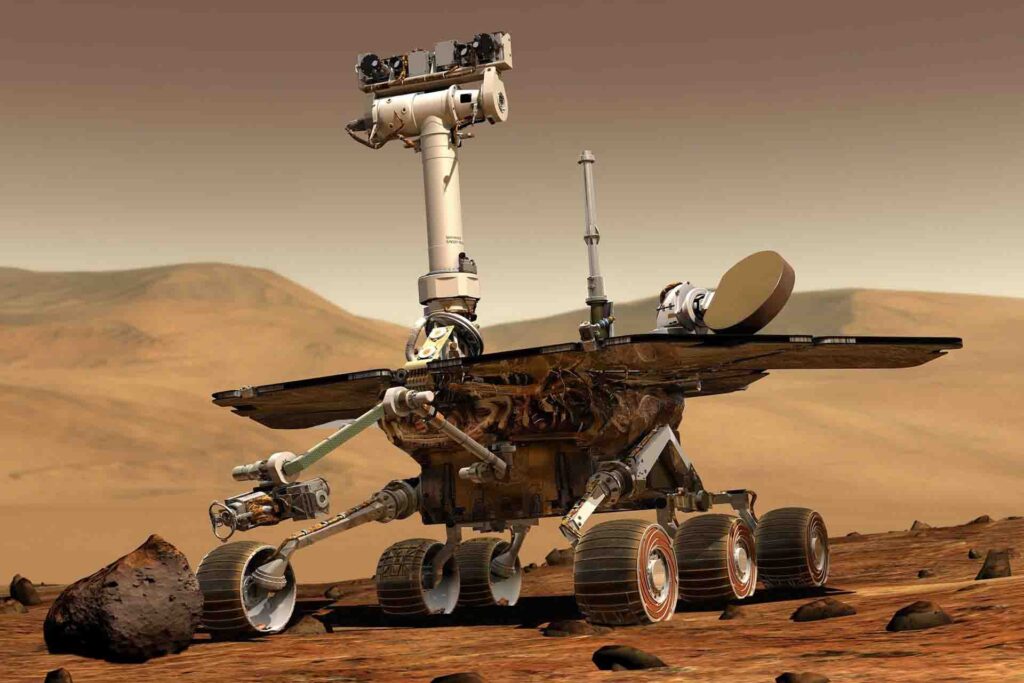

It is no question that the tech industry is broad. It is composed of dominant big tech firms, such as Apple and Microsoft, that have led the market, emerging mid-sized tech companies, and tech start-ups. As broad as the tech players are, the tech industry boasts an extensive array of products. These include the production of hardware such as computers, PC parts and components, smartphones, and even automotive parts. Along with it are software products that consist of programs, system tools, applications, storage, and security. The pursuit of modernization brought by the digital age caused the demand for innovation and the introduction of new tech products. As we strive to innovate, the demand for tech products continues to soar. This is evident through the rise of tech-breaking companies such as Tesla, on their electrically powered, self-driving vehicles, and Space X, which is revolutionizing space travel. A similar story involving market demand is also apparent on PC components, specifically Graphics Processing Units (GPU). As the public is continually enticed by the lucrative cryptocurrency craze, the demand for GPUs continues to rise and has resulted in the shortage of GPU parts and the exponential increase in market price. As we evolve in a tech-driven world, the tech industry is growing, hitting investment records and attracting investors.

Investing in Technology

With the rising demand for tech products comes the need for companies to constantly produce and implement innovations. The reality is, operations entail cost. And tech companies rely both on profit and investment sources to cover its cost and maintain their market position. The relative demand and the promise of profitability can easily persuade a potential investor to take the risk and position his investment with tech companies. But such a decision should not come hastily. In his decision-making, an investor should consider referring to TradingGuide and investing advice, conduct careful planning, perform risk assessment, and analyze the industry.

Tech Investment Tips and Takeaways

As in any investment opportunity, an investor should understand the kind of a market he or she will invest in. For technology investments, consideration may be focused on as to whether such tech product or service will continue post-pandemic. An investor should evaluate if the tech product is adaptable to changes due to the current global pandemic. As to risk, a potential investor should not be blinded or easily enticed to place his investment on demand-driven tech products. Research and assessment of the risks involved are vital to ensure that financial resources will not be placed in vain. The tech company size and performance should also be considered. New tech from a tech start-up company can be promising but may involve a greater rate of risk as compared to a well-regarded tech product of a multi-billion dollar tech company. An investor should also weigh the kind of tech product being offered by the company. There is a significant difference in novel tech products as opposed to mainstream tech products. Conclusion It is true that our society is under digital transformation and is heading to modernization with the help of the advancement of technology. However, riding the tech boom wave just for profit without an appropriate investment strategy might be precarious. As much as we can expect a return on investments, we should also expect dips and fluctuations in stock values in anticipation of unpredictable market performance brought by the current global pandemic. In this way, an investor can have a reasonable outlook as to the projected performance of his investment.